How to research and value NFTs

Introduction

When you ask yourself why you would buy an NFT, you can ask similar questions for why you would buy anything. Value can be based on perception and some people value rarity, while others value utility or practicality. NFTs can be both rare and useful, but the value of an NFT is determined by the person who buys or sells it.

When valuing an NFT, some key questions you can ask yourself are:

– Why am I minting/collecting this?

– Do I want to collect it because I like it?

– Do I believe it to be rare?

– Do I simply want to buy it so I can flip it?

– Is there some use-case (utility) behind the NFT I’m minting/purchasing?

– How soon after I get a PFP NFT do I make it my profile pic, so everyone knows I’m into NFTs?

These are some important questions to consider because the value of an NFT can be different for each person.

What does “minting” mean?

Minting allows you to convert your unique creation into a digital asset that is recorded on the blockchain. The process for minting can be as easy as connecting an Ethereum wallet to OpenSea and uploading your creation. For more instructions on how to mint on OpenSea, check out our How-To Guide for Minting an NFT. You can mint a variety of digital assets including art, video game pieces, and fashion items.

How to Value an NFT/NFT Project

Valuing an NFT/NFT project can be challenging but there are some key areas you can look at to help you separate the good from the bad.

For many people, it’s simply about the art – you either like it or you don’t, however, if you want to dig deeper and look beyond the visual, the below can help.

Does the NFT have utility?

Utility NFTs, as discussed in the last topic, are NFTs that have different functions. They can be in the form of digital tickets, exclusive memberships to clubs, or a piece of real estate in a metaverse. People will pay higher prices for NFTs with more utility, especially if they bring a tangible benefit.

Who makes up the team?

Knowing who is selling the NFT is important because it can help determine the legitimacy of an NFT. Knowing the creator can increase or decrease the value of an NFT depending on credibility, reputation, and popularity. If the creator is anonymous, it may be difficult to determine if they are legitimate. OpenSea, like Twitter and Instagram, uses a blue verification tick next to well-known sellers. This is an indication that the account can be trusted and isn’t impersonating a popular account. Examples are World of Women and CryptoCoven. That being said, just because an account doesn’t have a blue verification tick, it doesn’t mean it isn’t legitimate.

Is there venture support for this NFT project?

Venture capital investments in NFTs have gone up from $145 million in 2020 to $4.6 billion in 2021 (CBS News). Venture support can help keep the prices high for an NFT because it signals to the market that the project is quality, has a strong roadmap, and has an experienced team – retail investors often follow experienced investors (venture capitalists), and this positive flow of money into the project can push prices higher.

Are there any established partnerships for this project?

Partnerships can be really helpful in generating interest/buying activity for an NFT project. Aside from helping fund a project, partnerships can lend credibility and give buyers a better idea of the companies and teams that NFT creators affiliate with. It helps legitimize NFT projects from that creator, especially if they’re partnered with well-known, reputable businesses. Partners can also help with advertising and building hype for the release of NFT projects.

What blockchain is it built on?

NFTs are primarily built on Ethereum but can also be built on Solana, Tezos, and Flow Blockchain. Some popular marketplaces such as OpenSea and Rarible mint on the Ethereum blockchain. The blockchain it is built on will determine the cost of gas fees.

What are gas fees?

Gas fees are transaction fees paid to miners on a blockchain. Ethereum, for example, has high gas fees because there is strong demand for block space on the Ethereum blockchain. Marketplaces like OpenSea use the Ethereum blockchain to mint NFTs, so at times, when the network is experiencing a lot of activity, the cost of minting an NFT can be high. However, some marketplaces, like Mintable, are gasless (they simply absorb the gas cost and increase the listing/selling fee).

Should you mint an NFT or buy it off a secondary market?

Whether you should mint or buy depends on what you want to gain from investing in NFTs. If you’re minting on a project’s website, make sure they are reputable, and if you’re buying/selling on a marketplace, again, make sure it’s a reputable one like OpenSea, Rarible, Mintable, SuperRare, or Nifty Gateway.

If you decide to mint an NFT, here are some things to research:

Is it worth it?

Minting can sometimes be a lucrative exercise because projects will nearly always offer an attractive price to entice people to join their whitelist, and subsequently mint on the day of launch. Post-minting, buyers will typically post their NFTs for sale on a marketplace like Opensea, listing the NFT at a higher price than what they minted it for. The price will then be determined by the project's ability to market itself and deliver on its roadmap.

Is the project reputable?

As previously described in this blog, you must ensure the project, and its founders are reputable. Why? because in order to mint an NFT, you have to connect your wallet to the company's website (if you are minting on a marketplace's launchpad, you're connecting to the marketplace), and connecting your wallet to a 'phishing' site can lead to your assets being stolen from your wallet.

Is the live mint going to sell out?

When a project officially goes live for mint, a progress bar or number count will often be displayed, indicating how many NFT’s are left to mint. Hot projects sell out instantly, while not-so-hot projects will have low minting activity on ‘mint day’. When a project sells out on mint day, expect to see users list their NFT’s on the marketplace for a price higher than what they minted at. If a project doesn’t sell out on mint day or has slow minting activity, expect users will likely list it for cheaper on a marketplace.

Other questions to ask yourself when trying to determine the value of an NFT

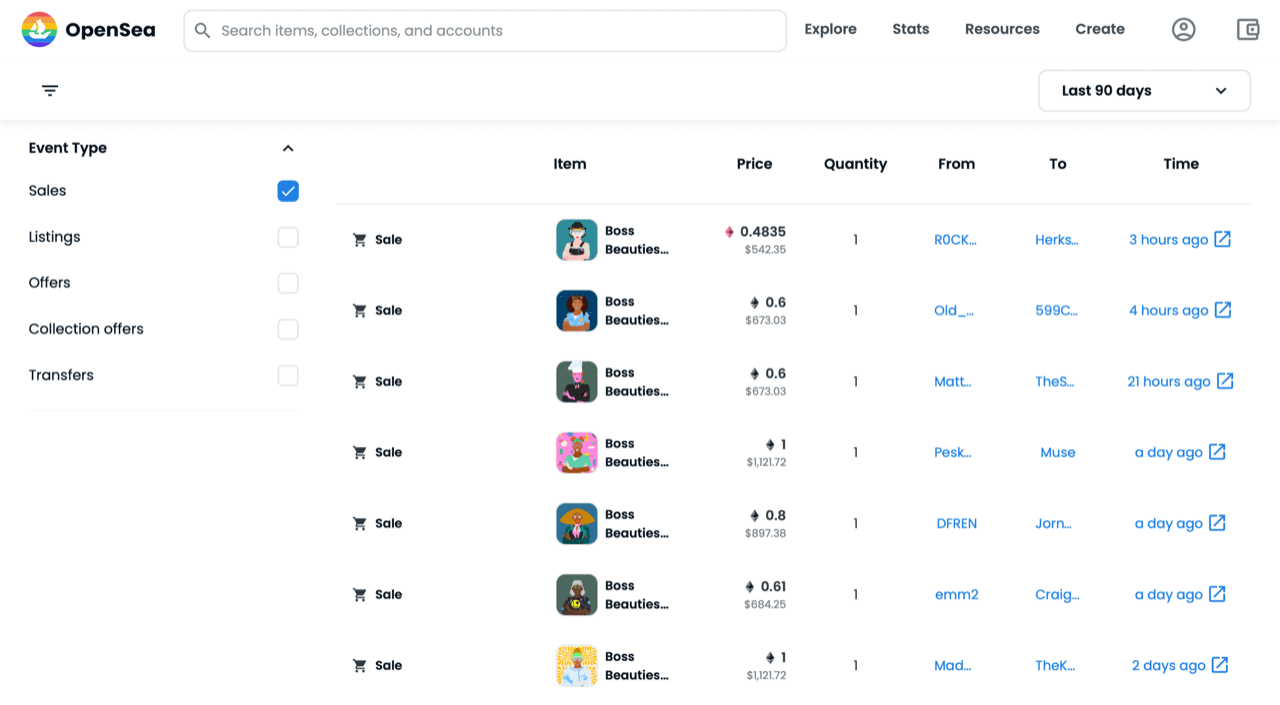

What are the price performances for the NFT you’re interested in and the other creations from the seller of that NFT?

You can track the Price Performance of an NFT by checking the seller’s account. This will give you an idea of the value of the NFT and the likelihood the price will jump if you want to flip it in the future. The floor price is the least amount of money a creator’s NFT costs. Etherscan is also a great tool to use to help you track price – more on that below.

Etherscan Token Tracker

Etherscan is an analytics program that works well as a token tracker. When on the website, under the tokens tab, simply click “ERC721 Top Tokens”. ERC721 is the token standard for NFTs. When you click on a collection, you’ll find information on minting, transfers, prices, etc.

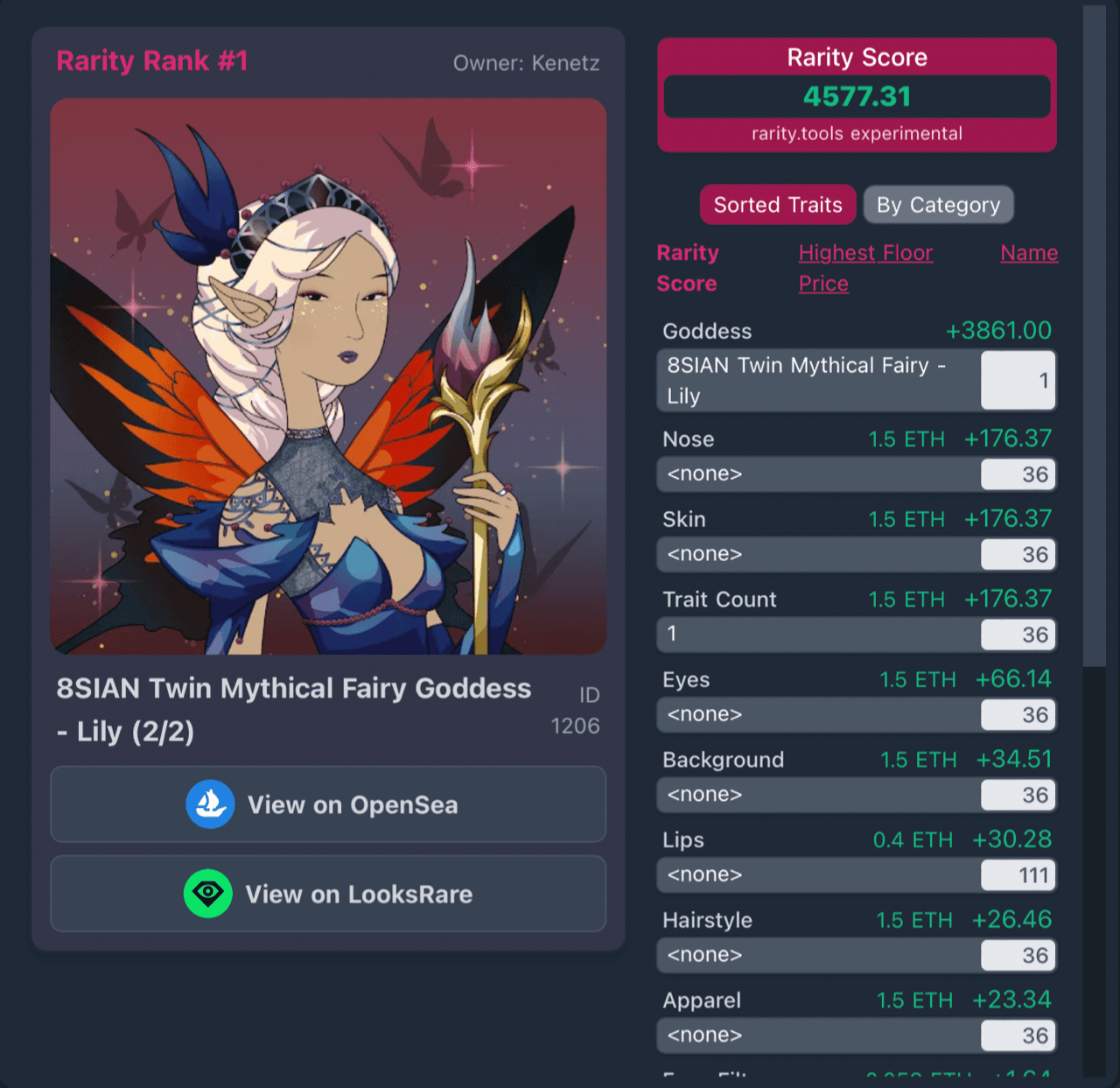

How rare is this NFT?

There are various ways to assess the rarity of NFTs which can help you determine their value. For PFP NFTs, for example, people can look at rarity traits and orientation of the picture, and based on that, the value can be higher or lower. With blockchain, you can see exactly how many copies of the NFT exist – this is another factor that will help determine how rare an item is. Popular tools to achieve the above are Rarity.Tools and Trait Sniper. Each of these are explored in greater detail below.

Rarity.Tools

Rarity.Tools ranks NFTs by rarity traits. It can help you find NFTs by average price, total sales volume, owner count, and top collections.

Which marketplace is the best to use?

The most popular marketplace for selling NFTs is OpenSea. OpenSea allows you to buy many different types of NFTs including PFPs, music, photography, sports, virtual worlds, and more. Other marketplaces like Rarible are great for digital art, books, and movie files. Nifty Gateway is another one that sells digital art but allows buyers to purchase NFTs with a credit card. This feature allows anyone to access art NFTs without a crypto wallet.

To recap

The value of an NFT can vary greatly from one NFT to another, but if you’re new to NFTs and want to collect your first one, it’s important to do your research. Key factors such as utility, team, venture support, and partnerships can help bring credibility to the project, and in doing so, increases the value of their NFTs. Sellers can mint NFTs and subsequently sell them on secondary marketplaces or buy them from the same. Depending on what they decide, they can use tools to research what gives NFTs more value such as Rarity.Tools and Ethereum Token Tracker. Whichever way you choose, take in as much information from as many resources as possible and have fun with it!